5StarsStocks.com Guide: Make Better Stock Trading Decisions Today

5starsstocks.com produces remarkable investment results. Users report a 20% growth rate within six months on recommended “5-star” investments. These numbers beat industry averages and show why traders flock to this platform. The service blends AI-powered analysis with complete market data to help investors make smarter decisions.

The platform offers free and premium subscription plans. Premium members get better perks with advanced analytical tools, instant market alerts, and expert stock picks. The system processes huge amounts of data from stock exchanges, financial news, analyst reports, and social media through advanced machine learning algorithms. Several longtime users have achieved steady returns of approximately 25% annually since 2013. Recent performance dipped slightly to 22% in 2024.

Before jumping in, you should know that independent reviews raise red flags about the platform’s credibility. ScamAdviser gives it a poor trust score. This piece gets into what 5starsstocks.com offers, how it operates, and whether it can actually boost your trading performance.

What is 5StarsStocks.com and how does it work?

Image Source: StockBrokers.com

5StarsStocks.com stands out from regular stock analysis platforms. It combines an easy-to-use interface with sophisticated artificial intelligence to deliver detailed investment insights. The platform makes stock market investing simpler for both newcomers and experienced traders. 5StarsStocks.com wants to help investors boost profits while keeping risks low through accurate analytical data.

AI-powered stock analysis explained

Advanced artificial intelligence powers 5StarsStocks.com by turning raw market data into practical investment insights. Multiple machine learning algorithms run on an advanced cloud architecture. The platform’s AI capabilities go beyond simple analysis and include:

- Predictive Analytics: The system forecasts stock performance based on historical patterns and current market conditions

- Sentiment Analysis: AI algorithms review market sentiment using news articles and social media trends

- Portfolio Optimization: The platform suggests strategic adjustments to maximize returns while managing risk exposure

The platform’s rating process gives a full picture by analyzing financial health metrics, market trends, and technical indicators. The AI system assigns ratings to thousands of stocks and marks the most promising opportunities as “5-star stocks”. Ratings update continuously so investors always have current insights.

The platform processes data much faster than human analysts, which sets it apart from traditional tools. It spots patterns, correlations, and anomalies that manual analysis might miss. On top of that, the platform’s machine learning models get better over time by learning from market changes and past trading results.

What does .com mean in 5StarsStocks.com?

A commercial website uses the “.com” domain, which you’ll find most often in business-oriented platforms. This domain shows that 5StarsStocks offers stock analysis services rather than being an educational (.edu) or organizational (.org) entity. Financial platforms often use the .com extension to show they’re professional services for the public.

Domain extensions help users tell different websites apart. The “.com” extension usually means legitimate business operations, though ScamAdviser has given 5StarsStocks.com a poor trust score. The platform works in many regions, making the widely recognized .com domain helpful for global access.

How the platform gathers and processes data

5StarsStocks.com uses an integrated data collection and processing system that works as a closed loop. The platform pulls information from many sources:

- Data Collection: Information comes from stock exchanges, financial news websites, analyst reports, and social media platforms

- Detailed Analysis: The collected data has historical price movements, trading volumes, company fundamentals, and broader economic indicators

- Fundamental Evaluation: Revenue growth, earnings patterns, and debt levels determine which companies receive high ratings

- Technical Assessment: Advanced algorithms analyze technical indicators including RSI, moving averages, and Bollinger Bands

- ESG Integration: Environmental, Social, and Governance metrics identify companies with strong sustainability commitments

AI algorithms process this massive data pool. The system creates practical insights by identifying trends, detecting anomalies, and making predictions based on recognized patterns. Market conditions get monitored continuously, and recommendations change based on new information.

Security remains crucial at 5StarsStocks.com. Strong encryption protocols, access controls, and data protection keep user information and sensitive financial data safe. The system processes immediate information through streaming technologies and low-latency frameworks. This ensures investors get timely updates without delay.

The platform’s integrated approach to data gathering and analysis gives investors research-driven insights in industries of all types, from technology and defense to consumer staples and healthcare.

Key features that help you trade smarter

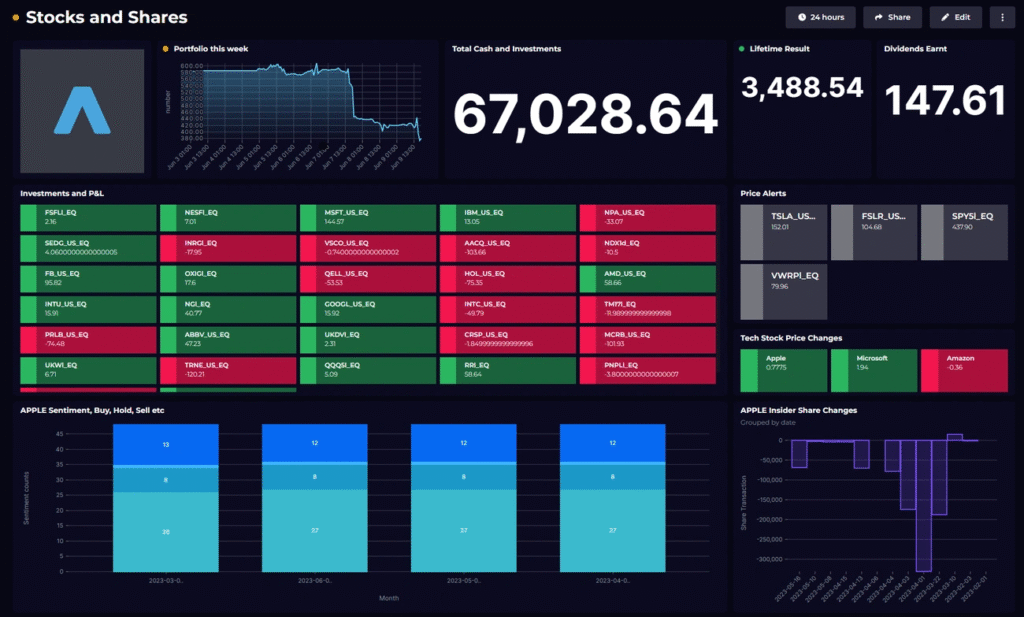

Image Source: SquaredUp

Key features that help you trade smarter

Modern stock market trading needs powerful tools that give timely information and useful insights. 5starsstocks.com stands out with a strong set of features that will lift both new and experienced investors’ trading abilities.

Up-to-the-minute data analysis and alerts

The platform helps investors catch every significant trading opportunity through its detailed alert system. Users get instant updates about price changes, market trends, and news that could affect their portfolio performance. This quick information helps traders take action and seize opportunities or reduce risks before market conditions change.

5starsstocks.com processes millions of data points daily from various sources like social media, financial news, and corporate filings. Smart algorithms track trending tickers, top-rated gainers, and give sector-wise breakdowns about market movements. These capabilities extend to breaking news alerts, earnings reports, and sector-specific trends that shape investment decisions.

The platform goes beyond simple alerts. It uses sentiment analysis with Natural Language Processing to review news articles and social media content. This gives users a better grasp of market perceptions.

Custom stock screening tools

5starsstocks.com’s advanced screening capabilities make finding the right investments easier. The platform has strong filters that help investors spot stocks matching their criteria. Users can create custom screens based on several parameters:

- Market capitalization and volatility

- Earnings performance and growth patterns

- Dividend yield and income potential

- Price momentum and technical indicators

- Environmental, Social, and Governance (ESG) metrics

These screening tools let investors filter thousands of stocks quickly. They match investments with personal risk tolerance and spot trend patterns for strategic entry and exit points. Users can export results to Excel or combine them with other trading platforms for deeper analysis.

Portfolio tracking and performance metrics

The platform’s built-in portfolio tracker makes investment monitoring smooth. Users can watch asset performance in real time, get rating updates, and learn about their specific holdings. A custom watchlist helps track potential buys with alerts at ideal ratings.

The detailed dashboard shows investors their complete financial picture with diversification analysis, risk assessments, and tax impact estimates. The system lets users set goals and measure performance against major indices like the S&P 500 and Nasdaq. A 2024 feedback survey showed 89% of users found these portfolio tools “very helpful” in making their investment strategy better.

The platform offers smart portfolio analysis and optimization for long-term investors based on risk tolerance, investment goals, and market conditions. This keeps each portfolio arranged with the user’s financial goals as markets change.

Educational resources for all levels

5starsstocks.com offers rich educational content for investors at every skill level, knowing that knowledge drives successful investing. The platform makes financial concepts easy to understand with guides that range from simple PE ratios to advanced options trading and swing strategies.

The learning library has interactive quizzes, videos, and worksheets. Topics cover stock market basics, financial statement analysis, technical versus fundamental analysis, and risk management strategies. These resources build user confidence whatever their experience level.

Each lesson gives practical, step-by-step guidance that traders can use right away. Many individual investors have used these resources to move from simple investing to more advanced methods. This has helped them improve their portfolio performance and make less emotional decisions.

User experience: Interface, dashboard, and mobile app

Image Source: Adobe Stock

User experience: Interface, dashboard, and mobile app

The way users access features determines how well a trading platform performs. 5starsstocks.com shines here with a design that makes everything easy to use without cutting back on features.

Clean and intuitive desktop layout

5starsstocks.com’s desktop interface stands out with its efficient organization that works for traders at every skill level. New users can direct themselves around the platform quickly thanks to its logical menu structure and well-labeled sections. The interface has:

- Interactive charts with customizable visualization options to analyze trends

- Quick search functionality to find specific stocks, sectors, or strategies

- Clear menus giving instant access to stock data, analytics, and financial news

The desktop experience really shines because of its flexibility. Users can customize their dashboards to match their investment goals and trading style. This personalization covers watchlists, alerts, and portfolio organization, so vital information stays within reach.

5starsstocks.com puts advanced tools right where traders need them instead of hiding them in complex menus. This smart placement lets users concentrate on market analysis rather than searching through complicated interfaces.

Mobile app features and performance

5starsstocks.com packs powerful mobile features for investors who need market access on the go. The app works on iOS and Android devices and brings core trading functions to phones and tablets.

The app’s quick alert system stands out. Active traders get notifications about market changes right away and can act fast on new opportunities. Busy professionals find this feature helpful when they juggle investments with other tasks.

The mobile app keeps the desktop version’s clean look while working perfectly on smaller screens. Notwithstanding that, some advanced features stay exclusive to the desktop platform.

Key mobile capabilities include:

- On-the-go portfolio management to adjust investments anywhere

- Push notifications with instant market updates

- Real-time trading with secure transactions

- Educational content to learn while mobile

Cross-platform synchronization

5starsstocks.com’s user experience truly excels at keeping everything in sync across devices. Users can start their research on desktop, analyze markets on their tablet during travel, and make trades on their phone—with perfect data matching.

The platform keeps everything current through immediate synchronization. Portfolio updates, watchlist changes, and market alerts stay fresh no matter which device you use. This happens automatically without manual updates.

Custom settings move between devices too, giving users the same experience everywhere. This cross-device feature becomes extra valuable during market swings. Traders can respond to changes without being stuck at one spot.

The platform’s responsive design adapts to different screens while keeping all functions working. This smooth experience across devices helps traders stay active in markets while going about their day.

How secure and compliant is 5StarsStocks.com?

Digital security breaches make headlines every day. 5StarsStocks.com uses a multi-layered security framework to protect user investments and personal information. The platform knows that investor confidence depends on both financial insights and strong security measures.

Data encryption and two-factor authentication

5StarsStocks.com protects sensitive information with advanced encryption protocols. This protection covers all data transmissions and storage systems. The platform’s protective mechanisms include:

- Two-factor authentication (2FA) that adds a crucial second verification layer beyond passwords

- Regular independent security audits to spot and fix potential vulnerabilities

- Immediate monitoring systems that watch for suspicious activities

- Secure data storage with encrypted backups to keep data safe

These safeguards work together to build a secure trading environment. The platform’s encryption standards match current industry best practices and create a strong defense against cyber threats.

Regulatory compliance and KYC/AML policies

5StarsStocks.com follows strict financial regulations. The platform requires Know Your Customer (KYC) and Anti-Money Laundering (AML) protocols to check user identity and guard against financial crimes.

These crucial compliance measures include:

- Detailed identity verification procedures

- Ongoing transaction monitoring

- Regular reporting to appropriate regulatory bodies

- Full risk assessment frameworks

These protocols are essential requirements for legitimate financial platforms. The KYC process usually needs basic identifying information like name, address, birth date, and government-issued identification numbers. The platform also performs extra checks for high-risk cases and looks for warning signs in transaction patterns.

User privacy and data handling

5StarsStocks.com’s privacy policy clearly states they do not sell, trade, or rent users’ personal information. The platform shares data only when:

- Trusted service providers help operate the site

- Legal requirements demand it

- They need to protect others’ rights or safety

Users control their information and can turn off cookies, unsubscribe from emails, and ask for data access or removal. The platform collects only necessary information and keeps it safe in protected databases.

5StarsStocks.com improves its security constantly to fight new threats. Regular security checks and staff training programs help the whole organization stay security-conscious. Independent audits and user feedback help improve the security setup, which adapts to counter potential threats.

This detailed security and compliance framework lets users confidently use the platform’s analytical tools.

Real user results: What traders are saying

A deep dive into real trader experiences with 5starsstocks.com shows mixed results with both impressive victories and notable failures. The platform’s user results paint a varied picture that deserves a thorough look.

Success stories and reported returns

Users have shared several remarkable wins from 5starsstocks.com’s recommendations. A trader saw their investment grow by 20% within six months on a ‘5-star’ pick in 2021, beating market averages. Another user’s portfolio earned 22% in 2024, which fell slightly short of their 25% yearly average since 2013.

Tech sector investments stand out with exceptional results. A trader’s Palantir investment shot up by an incredible 366%. The platform helped others build steady income streams too. Mike T., according to his testimonial, built a £952.99 monthly passive income using the platform’s high-yield stock screener.

Day traders found success as well. A user caught 15% gains in one trading session by using live breakout alerts. Some professional traders used the platform’s predictive analytics to reach 20% annualized returns.

Common complaints and limitations

Yes, it is true that users point out several big problems despite the good results. Users often complain about:

- Lack of historical data that could prove long-term success of recommendations

- Transparency issues about the analysts and their credentials

- Too much focus on quick gains instead of long-term growth plans

- Uneven performance in different market conditions

- Not enough options for seasoned traders

ScamAdviser’s review raises red flags about the site’s authenticity. Users worry about overly positive claims that sound more like marketing than facts. The platform clearly states that “investing in stocks involves the risk of losing money,” which highlights the risks involved.

How results vary by sector and strategy

Different sectors and investment styles show vastly different results. Tech and finance picks consistently deliver strong returns, like the Palantir success story mentioned earlier. Other sectors haven’t fared as well, with one investment in Kering dropping 36%.

The platform’s defensive stock picks held up well during market downturns, showing how its tools can help reduce risk. Patient investors often see more stable returns than day traders.

A long-term investor found a tech stock using the platform’s fundamental analysis tools that grew 200% over two years. Market conditions, personal risk tolerance, and investment approach play crucial roles in determining success.

How it compares to other platforms

A good understanding of how 5starsstocks.com fits into the wider financial platform landscape gives significant context to potential users who want to evaluate investment tools. The market has several alternatives that have been around for a while, each taking their own approach to stock analysis.

5StarsStocks.com vs Morningstar

Morningstar’s approach to stock analysis is different from 5starsstocks.com. This 40-year old financial giant rates stocks based on four components—economic moat assessment, fair value estimates, uncertainty around estimates, and current market price. 5starsstocks.com takes a simpler path and looks at current positioning instead of trying to predict future performance. Morningstar shows all its cards with published methodologies and verified analyst credentials. 5starsstocks.com has drawn some questions about its hidden methodology and unnamed authors.

Zacks and Investopedia comparison

Zacks sets itself apart as a trading-focused platform that offers options trading, Level II quotes, and direct market access. 5starsstocks.com thinks over this approach and stays away from live trading features. It positions itself purely as an analysis service. Their money-making approaches also differ. Zacks asks users to pay for withdrawals after their first free monthly withdrawal. 5starsstocks.com makes its money from subscriptions and teams up with financial literacy nonprofits.

Investopedia puts education first with its calculators, simulators, and detailed tutorials. It works more as a learning hub than a trading platform.

Unique strengths and weaknesses

5starsstocks.com stands out in several ways. The platform refuses to sell user data, unlike many rivals who profit from this information. Users can see probability sliders and confidence bands that show possible changes in stock profiles. The platform lets users participate by voting, commenting, and uploading research briefs.

In spite of that, the platform’s young age calls for some caution. Financial experts suggest double-checking its recommendations with proven services like Morningstar and proving it right against industry reports.

Conclusion

5StarsStocks.com will give a compelling package to investors who want AI-driven market insights. This piece showed how the platform combines artificial intelligence with detailed data analysis to help traders make better decisions. The platform’s 20% growth rate within six months and 25% annual returns since 2013 definitely catch attention, though these results need careful thought.

Users should think over both strengths and limitations before they commit. The platform’s reliable features—live analytics, custom screening tools, portfolio tracking—are a great way to get resources for traders at various experience levels. The accessible interface with cross-platform synchronization works well whatever your location or device.

Security measures like data encryption and two-factor authentication show the platform’s steadfast dedication to protecting user information. In spite of that, questions about authenticity remain, as shown by the poor ScamAdviser trust score mentioned earlier.

Results ended up changing by a lot based on sector, strategy, and market conditions. Tech investments like Palantir brought exceptional returns, while other sectors showed less impressive or even negative performance. This variability points to a basic truth: no trading platform guarantees success.

Over the last several years, alternatives like Morningstar or Zacks show both advantages and disadvantages compared to 5StarsStocks.com. The platform has unique features like probability sliders and avoids selling user data. However, its recent market entry and limited transparency about methodology raise valid concerns.

Financial experts suggest cross-referencing 5StarsStocks.com recommendations with other services before making investment decisions. Successful trading needs sophisticated tools along with sound judgment, diversification, and risk management strategies.

Your decision to use 5StarsStocks.com depends on your investment goals, risk tolerance, and willingness to verify information through multiple sources. Yes, it is possible the platform helps some traders improve their market performance, but it should be just one part of a detailed investment approach.

FAQs

1. What is 5StarsStocks.com and how does it work?

5StarsStocks.com is an AI-powered stock analysis platform that combines artificial intelligence with comprehensive market data to provide investment insights. It uses advanced algorithms to analyze stocks, assign ratings, and offer real-time analytics to help investors make informed trading decisions.

2. How secure is 5StarsStocks.com?

The platform employs multiple security measures, including data encryption, two-factor authentication, and regular security audits. It also adheres to KYC and AML policies. However, users should always exercise caution and conduct their own due diligence when using any financial platform.

3. What are the key features of 5StarsStocks.com?

Key features include real-time analytics and alerts, custom stock screening tools, portfolio tracking and performance metrics, and educational resources for investors of all levels. The platform also offers a user-friendly interface with cross-platform synchronization.

4. How does 5StarsStocks.com compare to other investment platforms?

5StarsStocks.com differentiates itself with its AI-driven approach and unique features like probability sliders. However, it’s relatively new compared to established platforms like Morningstar or Zacks. It’s recommended to cross-reference its insights with other reputable sources.

5. What kind of returns can users expect from 5StarsStocks.com?

While some users report significant returns, such as 20% growth in six months, results vary widely depending on factors like market conditions, sectors, and individual trading strategies. It’s important to remember that all stock trading carries risks, and past performance doesn’t guarantee future results.