ecrypto1.com Crypto Security: Hidden Threats Most Traders Miss in 2025

Crypto investors lost over $4.3 billion to wallet breaches and protocol-level hacks in 2025’s first half. This massive loss shows why ecrypto1.com’s crypto security has become vital for traders. The digital world has turned more dangerous as social engineering scams targeting token holders jumped 76% this year. Many investors still don’t know about the hidden threats to their digital assets.

Traders need to understand that crypto transactions can’t be reversed, which makes security breaches get very pricey. Phishing attacks, malware, exchange hacks, smart contract vulnerabilities, and private key theft pose constant threats. Traditional financial systems have time-tested safeguards, but crypto securities don’t offer much protection if something goes wrong.

ecrypto1.com says it tackles these issues with advanced encryption protocols, regular security audits, and multi-factor authentication. The platform markets its complete protection against market downturns and phishing attempts. But crypto.com’s privacy policy documentation makes it clear that fixing vulnerabilities needs more than basic security measures. This piece gets into the hidden threats most traders overlook and tests whether ecrypto1.com lives up to its security promises in 2025.

What is ecrypto1.com Crypto Security and What It Claims

ecrypto1.com crypto security offers a complete protection system built for cryptocurrency traders and investors. The platform sees itself as an “end-to-end crypto security ecosystem” rather than a simple tool or scanner. Its documentation shows how it uses multiple layers of defense to protect digital assets from various threats in the crypto world. The platform makes bold claims about what it can do, but these claims need a closer look.

Educational Resources on Wallets and Privacy Coins

Education serves as the lifeblood of ecrypto1.com’s security approach. The platform has rich resources that help users grasp key security concepts. Users can find detailed tutorials about spotting scams, keeping private keys safe, and setting up secure wallets. The platform also teaches best practices to protect cryptocurrency, which lets users take charge of their security.

The learning materials put special focus on privacy coins. ecrypto1.com says it has full integration of coins like Monero, Zcash, and Dash. These resources explain how privacy coins use advanced cryptography to hide transaction details and keep users anonymous in today’s surveillance-heavy financial world. These educational tools are a great way to get the knowledge needed to make smart decisions about digital asset security.

The platform helps newcomers understand simple concepts like:

- Cold storage: cryptocurrency storage where private keys are kept offline

- Privacy coins: cryptoassets that don’t publicly reveal all transaction details

- Wallet types: including self-hosted (user-controlled) and custodial options

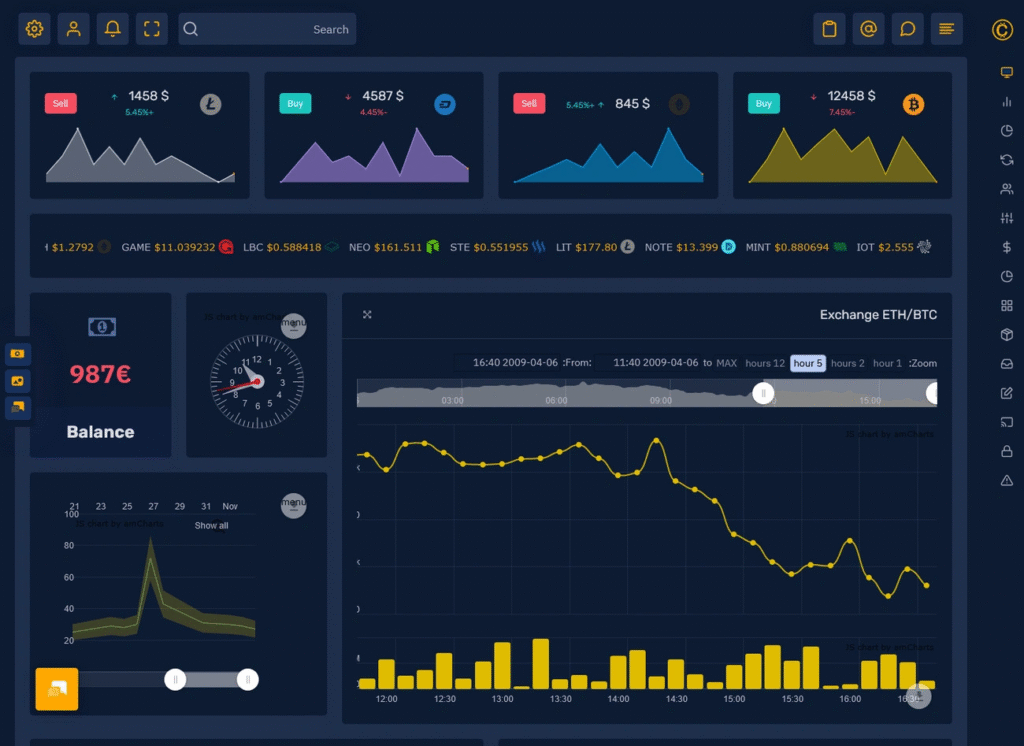

Security Tools: Live Analytics and Cold Storage

ecrypto1.com’s security setup revolves around key technical features. The platform uses advanced encryption protocols to secure private keys against unauthorized access. Live monitoring systems work alongside this to spot suspicious activities right away.

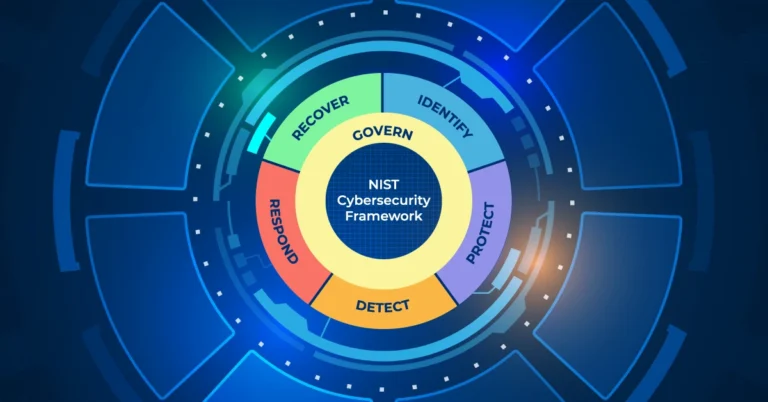

The security architecture has:

- Multi-layer protection that combines off-chain and on-chain analytics to spot threat patterns

- Behavioral AI that watches for unusual wallet activity

- Smart Contract Firewall that tests transaction intent before signing

- Cold storage solutions that keep most assets offline

Cold storage stands out as one of ecrypto1.com’s key security measures. The platform keeps user funds offline and away from online threats. This matches what industry leaders like Kraken do to protect client assets.

The platform uses two-factor authentication (2FA). Users must provide a second verification step, usually a mobile code, to access their wallets. The platform’s documentation states that it watches for suspicious behavior and flags any unusual activity to stop unauthorized transactions.

Promise of End-to-End Protection for Traders

ecrypto1.com aims to provide complete protection throughout your crypto trading experience. The platform promises “end-to-end crypto security” that covers everything from creating an account to executing trades. This protection works for both on-chain and off-chain activities.

The platform says it provides:

- Identity-first authentication with biometric access control

- Zero-trust vault storage with tamper-evident backup protocols

- Transparency Engine™ that shows public audit trails of policy changes

The platform regularly tests its security and runs audits to fix vulnerabilities before hackers find them. They also use verified smart contracts to reduce risks from code exploits.

Privacy-focused traders get special features for trading privacy coins, with secure wallets and low fees. The platform provides personal customer support to help with security issues quickly, adding another layer to its protection approach.

These claims sound impressive, but while the platform presents itself as a security leader, we should look carefully at how well these features actually work—a topic we’ll explore next.

6 Hidden Threats Traders Overlook in 2025

Cryptocurrency trading risks go way beyond the obvious threats. Security solutions have improved, but traders still face new risks that platforms like ecrypto1.com haven’t addressed. Here are six critical weak points that need immediate attention:

1. Outdated Wallet Guides with Generic Advice

Most traders depend on basic wallet security guides that don’t tackle specific weak points. Research revealed that wallets created between 2011 and 2015 using BitcoinJS didn’t have enough randomness in their cryptographic keys. This weakness affects Bitcoin and extends to Zcash, Litecoin, and Dogecoin, putting almost GBP 0.79 billion at risk.

Users with older operating systems face higher risks of attacks, especially those with Android-based wallets. Basic guides rarely highlight that useful tools like encryption and multi-factor authentication often sit unused because people find them too complex. This gap exists even though these tools protect against common hacking methods.

2. Broken Security Tools with No Audit Trail

Security platforms in crypto often lack ways to verify their effectiveness. Blockchain technology can create a valuable “audit trail” to track access and actions, but many security tools don’t use this feature. Users can’t check if their security measures worked during attempted breaches.

Security features often fail due to poor setup. Weak passwords, brute-force attacks, and unprotected key storage lead to most hacks. Hackers stole over GBP 1.75 billion in 2024 alone [link_2], yet platforms run without proper systems to track these security failures.

3. Misleading Third-Party Endorsements

Financial Industry Regulatory Authority (FINRA) found rule violations in 70% of crypto communications between brokerages and retail investors. These messages didn’t follow the rules about “fair and balanced” product descriptions.

The Advertising Standards Authority backed complaints against influencers who promoted cryptocurrency investments carelessly. Platforms use these misleading endorsements without showing their limits. FINRA warned that companies made false claims about how crypto assets work and wrongly stated that federal securities laws protected investors.

4. Lack of Real-Time Threat Detection

Security tools can’t keep up with blockchain innovation. New features appear faster than experts can test them, creating holes that attackers exploit. Anyone can deploy contracts or tokens on blockchain, which makes it easier for bad actors.

Spotting threats in real-time presents unique challenges. Legal trading and coordinated attacks can look identical on-chain. This makes it hard to spot harmful actions before damage happens. Organizations struggle to see their entire networks, leaving gaps where threats hide.

5. Surface-Level Privacy Coin Analysis

Monero, worth about GBP 108.80 per coin, uses special tech to hide transactions. Most security platforms only scratch the surface when analyzing these coins. They miss key differences between always-private currencies like Monero and optional-privacy ones like Zcash.

This basic approach creates big gaps in risk assessment. Privacy coins enable illegal activities like money laundering, darknet trades, tax dodging, and funding terrorism. Security platforms don’t analyze what makes each privacy coin unique, which leaves traders exposed to risks.

6. No Clear Data on User Protection Protocols

Security platforms stay vague about their protection methods. Cold storage offers the best long-term protection, but platforms rarely explain how they implement it. Hardware wallets stop most hacks by keeping private keys offline, but traders don’t get enough guidance about protecting these devices.

Phishing remains highly effective, with crypto losses reaching GBP 7.94 billion in 2024 from fraud and scams. Yet platforms share little about their anti-phishing strategies or how they educate users.

Critical Analysis of ecrypto1.com Security Features

Our analysis of ecrypto1.com’s crypto security features reveals several critical problems that traders should watch out for. The platform boasts about protecting digital assets, but a technical review shows major gaps between what they promise and what they deliver.

No Verifiable Security Audits or Certifications

The platform claims to run “regular security audits” to spot vulnerabilities. However, ecrypto1.com doesn’t provide any publicly available audit reports from known cybersecurity firms. This is nowhere near what you see with 10-year-old platforms like Binance and CoinGecko, which regularly share detailed security assessments.

Some sources say the system gets audits from Chainproof, Trail of Bits, and Quantstamp, but there are no links or certificates to prove these claims. The lack of transparency goes beyond security protocols:

- No details about the founders or how they operate

- No regulatory compliance papers

- No third-party verification of security measures

The crypto world runs on trust that you can verify. The platform’s lack of external validation raises red flags about its security capabilities.

Missing Hardware Wallet Integration Details

Hardware wallets are the gold standard for cryptocurrency security. Yet ecrypto1.com shares very little about its hardware wallet integration specs. They talk about “sophisticated protection features, including water and virus-proof capabilities”, but leave out crucial details about:

- Which hardware wallet brands work with their system

- How different wallets integrate

- Steps to set up hardware security

Their comparison table claims their wallets are more secure than “typical exchange wallets” and pack “more features and better usability than traditional hardware solutions”. These statements lack any technical proof or implementation details.

The platform says it uses “Hardware Security Modules (HSMs)” that give “physical protection against tampering attempts”. They also claim these modules provide “secure key generation with high-quality randomness”. Users can’t verify any of these security claims because there’s no documentation.

Unclear Implementation of Cold Storage Protocols

Cold storage keeps crypto assets offline and safe from online threats. It’s a crucial security feature that ecrypto1.com mentions often, but their implementation details are vague and contradictory.

One source describes their “hierarchical approach” to cold storage:

- “Major assets get transferred to air-gapped devices that never connect to the internet.”

- “Multiple backup locations store encrypted copies of keys.”

- “Physical security measures protect cold storage device.s”

Other sources just mention that the platform uses “cold wallet storage for the majority of its digital assets”. They don’t explain percentages, protocols, or ways to verify. Users can’t tell how much money stays in cold storage versus hot wallets.

The platform’s advertised tools, like up-to-the-minute data analysis, lead to broken pages. This doesn’t help build trust in their security setup. Many features they advertise, like “smart contract firewalls”, don’t have working demos or technical documentation.

The differences between ecrypto1.com and trusted platforms become clear when you look at how they handle security features. Legitimate platforms show you exactly how their security works. ecrypto1.com just makes claims without backing them up with technical details.

Comparing ecrypto1.com to Trusted Alternatives

8-year-old cryptocurrency platforms have clear advantages that newer platforms like ecrypto1.com can’t match. Looking at industry leaders shows major gaps in transparency, functionality, and depth.

CoinGecko vs ecrypto1.com on Wallet Reviews

CoinGecko, 9 years old now, has earned its reputation for accuracy and transparency in market data. ecrypto1.com’s wallet reviews only look at simple features. CoinGecko takes a different approach with its Trust Score system that helps users find secure trading exchanges. The system looks at multiple factors like liquidity, operations scale, API coverage, cybersecurity, team visibility, past issues, and proof of assets.

ecrypto1.com’s wallet reviews mainly talk about ease of use, supported assets, and simple security features. These reviews don’t stack up well against competitors and often show old information about existing wallets. The platform’s wallet guidance falls short of CoinGecko’s educational resources. CoinGecko offers detailed tutorials and a glossary that explains crypto terms clearly.

Binance vs ecrypto1.com on Security Tools

Binance has security measures that are better than ecrypto1.com’s claimed protections. Here’s what makes Binance stand out:

- They use a Secure Asset Fund for Users (SAFU) as an emergency insurance fund

- The platform offers address whitelisting for extra security

- Regular security audits are available to the public

ecrypto1.com says it offers “cold storage, 2FA, and continuous monitoring” but shows little proof of these security features. The platform doesn’t deal well with smaller exchanges and gives unclear information about regulatory compliance. Their security tools don’t meet the standards Binance has set.

Capterra checks more than 2.5 million reviews to make sure users get real software experiences. This makes ecrypto1.com’s unverified security claims look questionable.

Cointelegraph vs ecrypto1.com on Privacy Coin Coverage

Cointelegraph digs deeper into privacy coins with research-backed reporting. Their 2021 Privacy & Trust study looked at how users trust privacy on blockchain and exchanges. The results showed that 73% of users held back from making transactions because of privacy concerns. The study also found that 84% of users worried that wallet addresses didn’t give enough privacy.

ecrypto1.com’s privacy coin coverage lacks depth and insight. They only cover basic concepts without any real technical or market analysis. The platform misses key differences between privacy coins that Cointelegraph explains well, like private-by-default currencies versus opt-in privacy features.

Traders looking for solid information should stick to older platforms that offer complete analysis instead of ecrypto1.com’s basic content. The gap in quality, transparency, and depth between established crypto platforms and ecrypto1.com raises serious questions about what value they bring to the security space.

How to Choose a Reliable Crypto Security Platform

Traders need to evaluate several critical factors to pick a trustworthy crypto security platform. Cryptocurrency theft reached GBP 4.7 billion in 2022, and this is a big deal as it means that traders should use strict standards when picking security solutions.

Check for Transparent Audit Reports

Transparent security audits are the foundations of trustworthy crypto platforms. Legitimate services publish complete audit reports that classify vulnerabilities from “Critical” to “Informational.” Each vulnerability comes with suggested fixes from security experts. These reports show how committed a project is to transparency and user safety.

Look for these specific audit characteristics:

- Reports freely available to the public, not hidden behind paywalls

- Classification of vulnerabilities by severity level

- Documentation of resolved issues before launch

- Recognition on security leaderboards like Skynet

CertiK and other reputable auditing firms provide mathematical guarantees about smart contract behavior through formal verification techniques. These offer stronger assurances than simple code reviews. We approached platforms without transparent audit trails with extreme caution.

Look for Up-to-Date Educational Content

Quality educational resources show how committed a platform is to security. Advanced platforms go beyond simple tutorials and offer resources on evolving threats and countermeasures. First-rate educational content helps traders embrace security as a lifestyle rather than just a practice.

Educational materials should match current market conditions and threats. Guides discussing defunct exchanges or obsolete wallet technologies signal negligence. Legitimate platforms update their educational content regularly to address new vulnerabilities.

Verify Up-to-the-Minute Tool Functionality

Security tools need rigorous testing before you rely on them. Good platforms provide continuous monitoring with instant alerts for suspicious activities. They offer proactive measures against potential risks through complete ecosystem monitoring.

When evaluating tool functionality:

- Test alert systems with small transactions

- Verify integration with hardware wallets

- Confirm the platform can detect anomalous activities

- Check if the platform provides visibility into multiple blockchains

The most secure platforms use multi-layered protection. They combine on-chain and off-chain analytics to spot threat patterns before attacks happen.

Is ecrypto1.com Crypto Security Worth Your Time?

A full review of ecrypto1.com crypto security offerings leads traders to ask about the platform’s real value in 2025. We need to think about several key factors beyond surface-level promises.

Not a Scam, But Lacks Depth and Transparency

ecrypto1.com isn’t fraudulent but gives minimal real value to crypto investors or enthusiasts. The platform makes big claims about “end-to-end crypto security” and “smart contract firewalls” without showing solid proof for these statements. Its focus on SEO-driven strategies, old content, and lack of working tools makes it unreliable for anyone looking for real security insights. The platform seems to focus on being seen rather than being useful, with basic educational content that doesn’t match up to other established platforms.

Better Options Exist for Informed Traders

Smart cryptocurrency investors should stick to trusted platforms for practical insights since ecrypto1.com crypto security solutions don’t measure up. Here are some better alternatives that provide more value:

- Cointelegraph and Binance News deliver timely, credible updates

- CoinGecko and Coinmarketcap excel in data aggregation and market tracking

These platforms regularly go through security audits, show clear documentation, and keep their resources current with market conditions. ecrypto1.com just doesn’t meet these industry standards.

Use Caution When Relying on SEO-Driven Platforms

Many platforms, including ecrypto1.com, use hyped-up crypto security claims just to get more traffic. SEO poisoning—the malicious manipulation of search engine rankings—has become a cybersecurity threat in digital marketing. These platforms often care more about search rankings than user value and security, which creates risks for traders.

Trusting outdated crypto reviews on websites like ecrypto1.com can lead to big mistakes about exchange security and reliability. The cryptocurrency market changes faster than ever, and platforms keep updating their security standards, fees, and user rules. Even trusted exchanges might develop security issues, regulatory problems, or money troubles that older reviews missed.

Conclusion

Cryptocurrency security needs nowhere near flashy promises and marketing hype. Ecrypto1.com shows most important flaws compared to industry standards. The platform isn’t fraudulent but fails to add real value with its questionable security features, lack of transparency and shallow educational content.

Crypto traders face hidden threats in 2025. Outdated wallet guidance and misleading endorsements put users at risk despite claims of advanced protection systems. The platform lacks verifiable security audits, detailed hardware wallet integration and clear cold storage protocols. These gaps raise serious doubts about ecrypto1.com’s real capabilities.

Five-year old platforms are without doubt better choices. CoinGecko has complete Trust Score systems and Binance uses verifiable security measures like SAFU and address whitelisting. Cointelegraph’s research-based coverage on privacy coins leaves ecrypto1.com far behind.

Traders should set high standards to pick security solutions. They need to verify transparent audit reports, check if educational content stays current and test security tools properly. Crypto transactions can’t be reversed, which makes this watchfulness crucial.

Hackers and scammers have stolen billions through security breaches. Trusting platforms that care more about SEO visibility than practical use creates needless risk. Smart crypto investors should pick proven alternatives instead of platforms like ecrypto1.com that bring little real value.

Crypto security needs constant learning and adaptation. Smart traders pick platforms based on substance rather than marketing claims. This approach helps protect digital assets from evolving threats in the digital world of 2025.

FAQs

1. What are some hidden threats that crypto traders often overlook in 2025?

Some hidden threats include outdated wallet guides with generic advice, broken security tools lacking audit trails, misleading third-party endorsements, lack of real-time threat detection, surface-level analysis of privacy coins, and unclear data on user protection protocols.

2. How does ecrypto1.com’s crypto security compare to established platforms?

Established platforms like CoinGecko, Binance, and Cointelegraph offer more comprehensive and transparent security features compared to ecrypto1.com. They provide verifiable audits, detailed wallet reviews, and in-depth analysis of privacy coins, which ecrypto1.com lacks.

3. What should traders look for when choosing a reliable crypto security platform?

Traders should look for transparent audit reports, up-to-date educational content, and verifiable real-time tool functionality. It’s important to choose platforms that provide comprehensive security measures and regularly update their resources to address emerging threats.

4. Is ecrypto1.com worth using for crypto security in 2025?

While not fraudulent, ecrypto1.com lacks depth and transparency compared to established alternatives. It offers minimal genuine value to experienced crypto investors and relies heavily on SEO-driven strategies rather than providing substantive security insights.

5. How can traders protect themselves from crypto security threats in 2025?

Traders can protect themselves by using established platforms with proven track records, verifying security features, staying informed about current threats, and adopting a multi-layered approach to security. It’s crucial to be cautious of platforms that prioritize marketing claims over practical utility.